Will Chase Refund a Credit Dispute Under Paypal Friends and Family

What if yous sent $500 to the wrong person by fault and that person refused to give back your money? That's the shocking situation in which Rossin Asilo recently found herself.

Using the money transfer app Zelle for the get-go time, Asilo made a elementary typo entering her friend's phone number. That error dropped the cash intended for a memorial donation into the incorrect person'southward bank business relationship. Unfortunately, that stranger appears to view the transaction every bit a $500 windfall and will non return the money.

Now Asilo is hoping that the Elliott Advancement team can find a way to get her coin back. Simply that request might but testify to be an incommunicable task.

Yikes! I sent money to a stranger by accident

In early January, Asilo was saddened to hear about the death of her friend's mom. Funds were tight, and the family was asking for help with the funeral. She learned information technology was possible to donate via Chase using Zelle. Although Asilo didn't have a lot of extra cash, she was determined to ease her friend's plight.

"I wanted to donate, but I had never heard about Zelle before," Asilo reported. "I went into my Chase bank account and I saw that it was an approved style to ship money."

Looking over the information provided past Chase, the process seemed simple enough. Afterwards completing the Zelle registration, she downloaded the app to her phone.

"I entered the proper noun of my friend and his telephone number," Asilo recalled. "And so I requested to send $500 to the memorial fund. It was a lot of money to me, simply I really wanted to help."

After she clicked ship, the app asked her if she was sure about the transaction. Asilo confirmed and the money was instantly on its fashion.

Elliott Advancement is underwritten by Travel Leaders Group. Travel Leaders Grouping is transforming travel through its progressive approach toward each unique travel feel. Travel Leaders Group assists millions of travelers through its leisure, business and network travel operations under a multifariousness of diversified divisions and brands including All Aboard Travel, Andrew Harper Travel, Colletts Travel, Corporate Travel Services, CruCon Cruise Outlet, Cruise Specialists, Nexion, Protravel International, SinglesCruise.com, Travel Leaders Corporate, Travel Leaders Network and Tzell Travel Group, and its merger with ALTOUR. With more vii,000 agency locations and 52,000 travel advisors, Travel Leaders Group ranks every bit i of the industry'due south largest retail travel agency companies.

Unfortunately, while it's true that the coin was on its way, it wasn't going to the memorial fund. She had sent the money to the wrong person.

Asilo wouldn't find out for two days, but she had incorrectly typed her friend's phone number. That mistake caused Zelle (and Chase) to transport the cash to a complete stranger, who was happy to receive it.

Chase and Zelle: If you lot sent money to the incorrect person, enquire him to transport it back

Asilo had no reason to suspect that she had misdirected her donation. She received a confirmation from Zelle that the $500 had been sent and accepted. But a few days later on, the trouble became apparent when she spoke to her friend.

"When he said he hadn't received the donation yet, I became concerned that something had gone wrong," Asilo explained. "That'southward when I noticed that I had entered the telephone number incorrectly."

Asilo was quickly on the telephone with Hunt and asked what to do. She was stunned by the response of the Hunt representative.

The Hunt representative told me in that location was an piece of cake fix: I could correct my mistake by asking the stranger to send the money dorsum through Zelle. All I needed to do was call the number and ask that person. The agent said there was no fashion for the depository financial institution to reverse the transaction. I couldn't believe it. I mean, how could this exist the way to handle a client who sent a stranger such a large clamper of coin by mistake?

With a sinking feeling, Asilo realized that Hunt was telling her that the fault was all hers to correct. When Zelle gave her similar instructions, she picked upwards the phone once once more.

Asking a stranger: I sent you money past mistake. Tin you lot please send it back?

With trepidation, Asilo dialed the number of the person to whom she had sent the $500 in error.

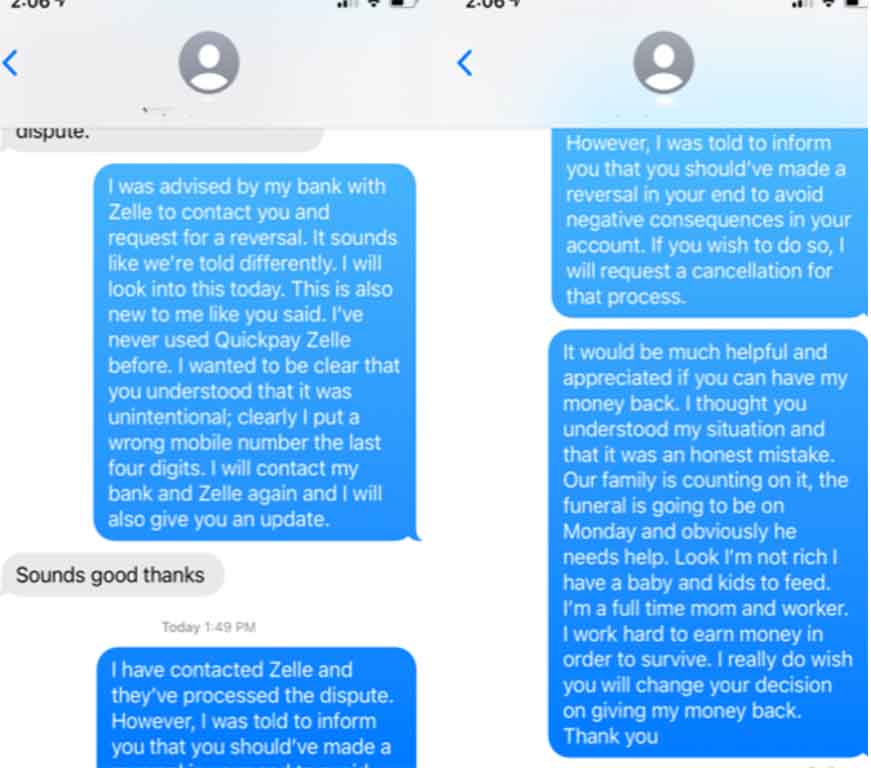

A human quickly answered the phone. She says that initially, he seemed pleasant and more than willing to fix the problem.

I told him what happened. He answered in a friendly and understanding tone. I told him that Hunt and Zelle said he should just contrary the transaction — send the money back though the app. He said, 'okay, sure, merely allow me become home and do that on my computer.' Only in a few hours, he texted me and said he wanted to contact his bank for more information. The next day, he told me that his bank suggested that I file a dispute — he was unwilling to reverse the transaction. I asked him for his full name and he refused to tell me. So stopped responding to me.

Things were starting to look bleak, and Asilo says she called Chase again and asked what to do. She explained that the stranger she had sent the money to past fault was unwilling to ship it back.

Asilo hoped that a reasonable resolution would be for Chase to reverse the charge through Zelle. But that hope was quickly dashed when the banking company representative explained a elementary reversal wasn't possible. The banking concern would need to comport an official investigation.

Chase then allowed Asilo to open a fraudulent transaction dispute. For the time being, the depository financial institution returned the $500. She was hopeful that the money would soon help pay for her friend's mom'south funeral.

Just then…

Hunt: You authorized Zelle to send the money to this phone number

Several weeks later, Asilo received terrible news. Chase had determined that error or not; she had authorized the transfer of money to the stranger through Zelle. The bank removed the $500 from her business relationship once more.

Desperate for aid fighting this battle, Asilo and then sent her request to the Elliott Advocacy team.

Please aid me! I wanted to send my coin to our family fellow member whose mom passed abroad. They needed help for memorial service, and I used Zelle for the first fourth dimension. Unfortunately, I mistakenly sent the money to a stranger. I accidentally entered the terminal digits of the phone number wrong. Tin can you lot do annihilation virtually this? (Asilo to the Elliott Advancement team)

Elliott Advocacy investigates: Who is the stranger that won't requite back the $500?

When I read Asilo'southward plea, I was immediately adamant to become the $500 back where information technology belonged. Asilo was trying to help a grieving family pay for a funeral. Why should a faceless stranger have advantage of a simple mistake and interfere with that intention?

Information technology's an exceedingly awful person who would pocket a donation meant for a funeral fund. I decided to observe out who was behind that number.

I did some online sleuthing and voila!

That stranger wasn't faceless anymore.

Elliott Advocacy: Please give dorsum the coin that was sent to you lot by error

The telephone number turned out to belong to a pocket-size, family-run air conditioning and heating company in California. Ironically the owner claimed on his website that he had built his business on "honesty."

Right.

There on the visitor'south website was a smile photograph of the stranger who was refusing to render the $500 meant for a funeral fund. He was standing in front of his company's van with his phone number on display — the i that Asilo has mistakenly typed into the Zelle app.

I hoped a short email or text would put a quick cease to this trouble.

Howdy ****,

I'm a consumer reporter working with the nationally syndicated columnist Christopher Elliott. Rossen Asilo contacted us (Phone number *********). As you know, she accidentally sent $500 through Zelle to your visitor'south official phone number (*********). She has texts that she provided to me where you're discussing the fault. She asked you to reverse the transaction and you refused.Every bit this is non your money and it'southward meant to get to a grieving family as a memorial donation, we're contacting you to enquire you to ship back the the money that she sent to you past accident.

Since there is no ground for you to proceed it and your company's website says honesty is one of your selling points, it seems unusual that you lot did not immediately reverse this transaction afterward Ms. Asilo contacted you last month. (Michelle to the possessor of the visitor.)

To ensure that the no-longer-anonymous stranger received my inquiry, I sent several texts to his phone number besides. (The same number to which Asilo had mistakenly sent the $500)

If you lot sent money to a stranger by mistake you might not get it back

The owner did not render my e-mail or text. Then I turned my efforts to Zelle. Surely their team would desire to make sure the coin made information technology to the right person.

But when I looked at Zelle'due south terms of service, I could see that they weren't on Asilo's side. Information technology's upward to the consumer to brand certain that they're sending their funds to the correct email or telephone number. Once yous send a payment to any phone number or e-mail, if that person is enrolled in Zelle, your money is in that person'due south hands. There is no mechanism to reverse the transaction in Zelle — just like a wire transfer.

And that makes sense. Of course, Zelle can't investigate the intention of every person who sends money through the app. The ultimate responsibility not to send money to the wrong person lies with the user.

But I thought the Zelle team might want to take a closer look at this particular example. The benefactor of Asilo's mistake clearly took advantage of the situation. In my mind, it seems a lot like theft. And since the person was no longer an anonymous stranger, I hoped that Zelle and Chase would detect the electric current situation an unacceptable outcome.

Asking Zelle: This customer sent cash to the incorrect person. Now what?

Hi Zelle friends!

I of our readers contacted u.s., who has had a disturbing problem with a Zelle transaction. We hoped your squad might be able to provide some insight and maybe be able to help hither.

Rossen Asilo was attempting to transport a $500 memorial souvenir to a family unit friend who has recently lost a loved i. Using the Zelle app, she made a typo while entering the telephone number. She included the correct name of the person she was trying to send the payment to, but the payment went to a stranger. That stranger kept the cash fifty-fifty though it was non addressed to him.

Chase recommended that Ms. Asilo inquire the stranger but to contrary the transaction, which seems similar an easy fix. Except this person inexplicably refused to give back the money and now he refuses to reply any more texts from Ms. Asilo or my inquiry. I've searched for the telephone number and it is registered to a visitor called ************ and **** ***** is the possessor. (The telephone number associated with this Zelle account and his business organization is ********). Ms. Asilo's Zelle account is *********

Is at that place annihilation that can be washed if a Zelle user sends cash to a stranger (who is easily identifiable) and that stranger refuses to render the accidental payment? The text letters between **** and Ms. Asilo are below my signature. Thank you for any insight/help yous can provide! (Michelle to Zelle)😊

A goodwill gesture from Chase

And soon, both the Zelle and Chase teams agreed that this was not an acceptable event.

I've not named the air/heating company or owner at the center of this case because the investigation is ongoing at Chase's level. But the good news for Asilo is that because of her long-term expert customer history with Hunt, the bank has returned her $500 every bit a goodwill gesture. Her part of the story is over.

Howdy Michelle, Thanks for bringing this issue to our attention. We were able to issue Ms. Asilo a credit and it should be applied to her account no later than Monday. Consumers should double-check the email or phone number of the person they are sending money to before authorizing a Zelle transaction. This will ensure that the coin isn't sent to an unintended recipient. (Chase spokesperson to Michelle)

Although I'm super pleased that Asilo got her money back, I hope this businessman volition not be immune to turn a profit from her fault. I don't believe he is the honest person he claims to be.

How to make sure that you don't send coin to the wrong person

Sending money instantly to friends and family unit can indeed exist a great convenience. But when used carelessly or inappropriately, these greenbacks apps tin also atomic number 82 to instant and costly problems. Here are some things to remember when using these services and so you tin can avert your ain money transfer fault.

- Read all the terms of service (TOS) of the greenbacks app

Certain, information technology'southward tedious to read many pages of fine print. Simply entrusting your money to a cash app you don't fully empathize is unwise. Unfortunately, we know that many consumers don't read through those documents until it'due south as well tardily. Each yr, our team receives hundreds of complaints from distraught PayPal users who find their accounts (and greenbacks) frozen. (See: Banned from PayPal and she doesn't know why.) Had these consumers read through PayPal's TOS, they'd have learned the company tin freeze accounts for upwardly to 180 days with petty caption. The bottom line: You'll larn many important things by reading a company's terms of service. If you read it all, you might only make up one's mind the app isn't for y'all. But if you don't read information technology and use the service anyway, you'll exist held to those terms. Then keep that in mind. - Simply send money to friends and family

All of the cash app companies warn users to but transport money to friends and family unit. It's a mistake to misuse these money transfer services and transport coin to people you don't personally know. Be aware that scammers beloved wire transfers, and cash apps are very similar. One time you send coin through these platforms, it'due south gone — the banking concern can't call it back. Follow the rules set upward past Zelle: Never pay a stranger for a product or service using the app. That's a recipe for a scam. (Run across: How to hands avoid a costly vacation rental scam) - Fees may employ

Exist aware that most, but not all, transfers done through cash apps are free. Yous'll want to also check with your bank and/or connected credit card visitor, since those companies may charge fees fifty-fifty if the app does non. - Fair Credit Billing Act does non utilise

The Fair Credit Billing Act protects consumers who use credit cards to make purchases. If in that location is a trouble with a product or service, your credit menu visitor tin get your money back via a chargeback. The FCBA does not apply to purchases made with debit cards or greenbacks apps. If a seller (even 1 you know) asks you lot to pay for a product or service using a cash app, always decline. (See: This is how she rapidly lost $i,300 to a stranger using Venmo) - Double-bank check the recipient's email or phone number

Before y'all send coin through an app, bank check and and so double-check the accurateness of the email or phone number. Even the tiniest of typos can send your cash sailing into a stranger's bank account. And unfortunately, as today's story shows, not everyone is honest. If you brand a error, your money could end up in the easily of a quack stranger who won't give it back — and you'll take no way to brand them render information technology. (Michelle Couch-Friedman, Elliott Advocacy)

Update: Does this Zelle transaction mimic the Venmo Chargeback Scam?

Later on this commodity was published, quite a few readers expressed concern for the recipient of this mistaken cash driblet. That reaction took me by surprise. But every bit I read through the comments, I had to admit, the concerns were not unfounded.

Here's why.

Recently, criminals have targeted the Venmo platform with a scheme in which they send money into a stranger's business relationship. They do this using a stolen credit card as the funding source. Then the scammer contacts the recipient of the "fault" and asks them to transport back the coin. In that location is often a deplorable story fastened to the urgent plea for the return of the funds.

When the unsuspecting recipient sends the coin back via a new, separate transaction, it's credited to the thief's Venmo. The scammer and so takes the money and moves on. After the owner of the stolen credit card that funded the transaction will likely file a chargeback dispute. Now the original transaction is reversed and the money is removed from the victim's Venmo.

This week, I spoke to our executive contact at Zelle to analyze a number of topics. Primarily, I wanted to know if the Venmo Chargeback Scam could happen using Zelle. I also wanted to know what a person should do if they suddenly discover a pile of cash in their bank account dropped there by a total stranger.

Zelle: "The Venmo Chargeback Scam isn't possible on our platform"

So here's what you need to know about the departure betwixt Zelle and Venmo.

The spokesperson explained that the Venmo Chargeback Scam is not possible on Zelle because these transactions are bank-to-bank transfers. The Off-white Credit Billing Act only allows consumers to file chargebacks for credit card transactions. Information technology'southward non possible to fund a payment on Zelle with a credit card.

Zelle users should view their transactions like a wire transfer. There is no mechanism for a consumer or bank to call back a wire transfer — or a Zelle payment.

I asked our contact if a depository financial institution would take advised its customer not to send back a mistaken Zelle payment. Here'southward what she said:

Obviously, we don't know for certain what his banking company told him. Just we have agreements with the banks that make Zelle available to their customers. Those banks understand that chargebacks of Zelle transactions aren't possible. So there wouldn't be whatever manner for [Asilo] to get her money returned via that route. His bank would have known that. The money would only be returned if he (the owner of the ac company) agreed to send it back. His banking concern should have been able to facilitate that process. (Zelle spokesperson)

Zelle: "All transactions are irrevocable — so make sure yous aren't sending money to the wrong person."

Several times during the telephone call, our executive contact reiterated that "Zelle transactions are irrevocable." For this reason, consumers using Zelle should exist extremely cautious when sending payments to friends and family unit. It's critical to thoroughly read all prompts earlier hit the concluding confirmation.

If you send money to the wrong person by accident, or if y'all transport coin to a scammer (Come across: A pet scam cost this victim $4,000. Could y'all fall for it?), there is no safety cyberspace — all Zelle transactions are concluding.

Hunt confirmed that information technology never reversed Asilo's Zelle transaction even when it was investigating her complaint (information technology only temporarily credited her account).

Annotation: The only way the bank would have reversed the Zelle transaction is if it was proven the receiver had somehow fraudulently accessed Asilo's account and sent the payment to himself.

Chase and Bank of America agree: Zelle users can't reverse their transactions

This week, I also spoke to our executive contact at Banking company of America near Zelle subsequently one of its customers contacted me about another misguided payment.

Theresa Pasquenelli entered an incorrect area lawmaking during a Zelle transaction several weeks ago. That sent her money sailing into the wrong person's depository financial institution business relationship. And that stranger also decided it was a surprise windfall — and quickly spent the $600.

Long story curt, I sent $600 to the wrong person through Zelle. I fabricated a mistake with the expanse lawmaking. We called BofA, who told united states of america basically we are out of the coin unless we contact the stranger who received information technology. They likewise said I could file a constabulary study. Nosotros did end up calling the recipient, who was non besides thrilled by our call. At showtime, he said he knew zip of the situation. But and so admitted that he spent the coin right after he received information technology. He no longer had the $600 to give back.

I asked Bank of America if a consumer sends money to the incorrect person by accident is there whatsoever style to recall it?

If you lot send money to the wrong person is there a style to get it back?

The uncomplicated answer to that question is "no." If you transport money to the incorrect person, y'all won't get information technology back unless the recipient agrees to give information technology dorsum. Neither the banking concern nor Zelle tin/volition strength the stranger to return your cash.

Hi Michelle, For your background, we practise remind customers to ensure that their recipient's contact data is correct before finalizing the payment. When sending coin via Zelle to someone for the first time, the client sees a screen confirming the telephone number and recipient's get-go proper name before completing the transaction.

In this case, the customer proceeded with the transaction even though the name did not match her intended recipient. We did reach out to the recipient's bank to try to have the money returned to our client'southward account. [That bank] declined our request, so at that place is null more we can do. (Banking company of America spokesperson)

What to do if you lot sent money to the wrong person

Contact your banking company ASAP: In some rare circumstances, y'all may exist able to terminate the transfer if you act chop-chop enough. So as soon as you discover you've sent money to the incorrect person, call your bank and give them all the details of your error.

- Contact the recipient of your fault: All the banks and money transfer services give this same recommendation: If you brand a mistake and send money to the wrong person it is your responsibility to effort to get information technology dorsum. Privacy laws prevent the bank and transfer companies to reveal the identity of the receiver, but you'll have some minimal contact information in your ain cash app account. Unfortunately, it will be entirely up to that person to decide how to proceed.

- Be polite: We've repeatedly seen consumers who have created this situation, turn on the receivers of the wayward funds. Remember, your mistake is not the recipient's problem to gear up. With that in mind, go on your correspondence with the stranger who received your money by mistake cordial. They likely want to resolve the problem likewise and cooler heads will prevail.

- File a police force written report: If you've contacted your bank and the recipient and there is a large amount of money at stake, y'all may wish to contact your local police department. As we've seen in other cases, some recipients are unwilling to send the money back for fearfulness of becoming the victim of a scam (Come across: If you lot suspect a scammer sent you money, what can you practise?). Your local police section may be willing to assist facilitate the peaceful render of your money.

- Contact an attorney: If you lot've sent a giant wad of greenbacks to a stranger who won't give it dorsum, you may need to involve a legal team who can suggest you lot farther. Of course, legal guidance can be quite expensive and complicated. Call back that when you set out to make your next cash app transfer. This type of error is easily avoidable if you use caution during all transactions.

What to practice if you receive a lump of cash from a stranger through Zelle

Unfortunately, at this fourth dimension, there does not seem to be an official way to render money that arrives in an account past mistake via Zelle (Run across: If a stranger sends you money by surprise, tin you proceed it?). There is also no mechanism to refuse a surprise Zelle payment past a stranger. Just our contact at Zelle offered these tips for what yous tin can do if y'all suddenly detect someone has dropped money in your business relationship.

- Contact the sender

If a stranger makes a mistake and sends you a wad of cash through Zelle, call the person and verify their identity. The more data the person will give you almost themselves, the less probable you lot are dealing with some type of scam. Then… - Enquire your bank for help

Your bank should be able to facilitate the return of the misguided cash. If you transport dorsum the money with your bank's assist and approval, you'll also be documenting every step of the transaction. That will make it much more difficult to impossible for a potential scammer to claim fraud later.

Earlier yous go: Yes, the Venmo chargeback scam may non work on Zelle, simply here are 5 ways scammers are operating on Zelle.

alngindabubabsizarly.blogspot.com

Source: https://www.elliott.org/problem-solved/sent-money-stranger-mistake-wrong-person/